If you’re blacklisted in South Africa, getting a traditional loan can be extremely difficult. However, loans for blacklisted individuals offer an alternative route, often through private lenders or microlenders.

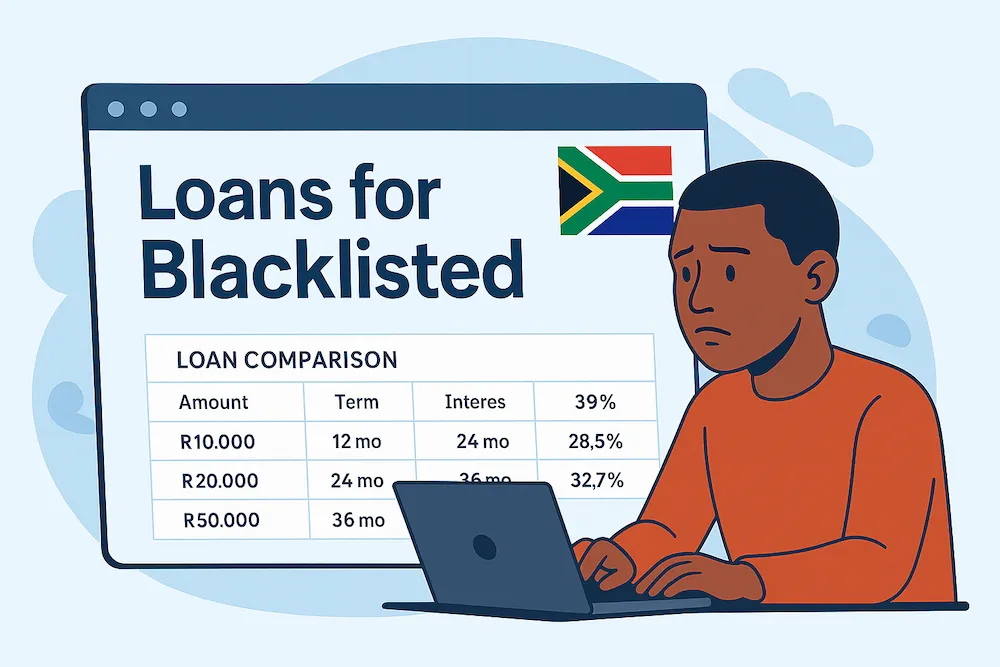

Loan Limits, Repayment Terms & Interest Rates

Loan Amounts: R1,000 to R150,000

Loan Terms: 1 to 60 months

Interest Rates: 20% to 27.75% APR (NCR regulated)

While these loans are more accessible, they usually carry higher interest rates to balance the lender’s risk.

| Select the loan you request: |

| Loans for Bad Credit |

| No Credit Check Loans |

What Does “Blacklisted” Mean in South Africa?

Being blacklisted typically means:

You have a low credit score

You have judgments or defaults listed on your credit report

You may be under debt review or have missed previous repayments

Despite this, some lenders still offer loans — with a focus on affordability rather than past credit behavior.

👥 Who Can Apply?

You may qualify for a blacklisted loan if you:

Are a South African citizen or permanent resident

Are 18 years or older

Have a regular income (minimum R2,500/month is common)

Have an active bank account

Can provide proof of income and residence

Most lenders will skip the major bureau credit check and instead verify your ability to pay based on current income.

📄 Documents You’ll Need

Even without a credit check, documentation is still essential:

SA ID Document

3 months of payslips or bank statements

Proof of residence

Employer contact details

📊 Example Loan Table for Blacklisted Borrowers

| Loan Amount | Term | Interest Rate | Monthly Installment | Total Payable |

|---|---|---|---|---|

| R2,000 | 3 months | 25% | R760 | R2,280 |

| R7,500 | 12 months | 26.5% | R720 | R8,640 |

| R15,000 | 24 months | 27.75% | R900 | R21,600 |

Note: Exact figures may vary between lenders.

❓ Frequently Asked Questions

🔹 Can I get a loan if I’m blacklisted in South Africa?

Yes. Several lenders specialize in loans for blacklisted individuals, focusing on your income instead of your credit history.

🔹 Are these loans legal?

Yes, if the lender is NCR-registered and operates under the National Credit Act.

🔹 Can I apply online?

Absolutely. Many providers allow for fully digital applications and same-day payouts.

🔹 Do I need collateral?

Most blacklisted loans are unsecured, meaning no collateral is required.

🔹 Will this loan help improve my credit score?

If your loan provider reports repayments to credit bureaus, and you pay on time, it can help rebuild your credit over time.

Final Thoughts

Being blacklisted in South Africa doesn’t mean you’re out of options. A range of licensed lenders offer loans tailored for people in your situation. The key is to borrow responsibly, compare offers, and always verify lender credentials.