This panic is exactly what high-interest lenders rely on. They know that if you are rushing, you won’t look at the interest rate or the fees. But taking a fast loan to solve a temporary problem often creates a permanent one.

Before you sign a contract that locks you into months of repayments, take a deep breath. There are safer, cheaper, and often faster ways to solve your problem than borrowing. This guide explores alternatives to fast loans in NZ.

Is a Loan Actually the Fastest Solution?

We assume borrowing money is the quickest fix. But consider this:

- Loan Application: Takes 30 minutes to apply, hours to verify, and potentially until the next day to clear funds.

- Phone Call to Provider: Takes 10 minutes.

Often, negotiating the bill itself is faster than borrowing money to pay it.

1. The “10-Minute Fixes” (Bill Extensions)

If you need money for a specific bill, don’t borrow. Negotiate.

Power and Internet

NZ providers have hardship teams. Call them and say: “I cannot pay my bill today, can I extend it by 7 days?”

Result: 90% of the time, they say yes immediately. Cost: $0.

Rent or Mortgage

If you are short on rent, talk to your landlord or bank immediately. Banks can offer “Mortgage Holidays” or interest-only periods during hardship. Landlords often accept a payment plan if you are upfront.

2. Urgent Support (When You Have $0)

If your bank account is empty, you may be eligible for emergency assistance.

Work and Income (WINZ)

You do not need to be on a benefit to get help.

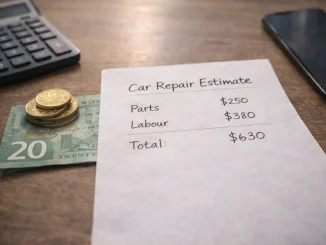

Recoverable Assistance Payment: An interest-free loan for essential costs (car repairs, appliances).

Food Grants: If you have no food, WINZ can often load money onto a payment card the same day.

Food Banks

Using a food bank for one week saves you $150–$200 at the supermarket. That is $200 cash you now have available for other bills, without borrowing.

The 7-Day Crisis Plan

Stop the panic and follow this plan to stabilise your finances:

Day 1: Stop Spending

Check your bank app. Pause any automatic payments for subscriptions or savings. Keep every dollar for essentials.

Day 2: Negotiate

Call your creditors. Ask for extensions. This stops late fees and gives you breathing room.

Day 3: Sell to Survive

List unused items on Facebook Marketplace. Cash from selling an old bike or phone is immediate and interest-free.

Day 4: Seek Mentoring

Call MoneyTalks (0800 345 123). They can connect you with a mentor who can advocate for you with lenders.

Conclusion: Speed Can Be Dangerous

Fast loans solve the symptom, not the problem. By using the alternatives above, you protect your future income from high interest rates.

Always try to negotiate first. If you absolutely must borrow, ensure you understand the risks outlined in our same day loans guide.

Be the first to comment